Abstract

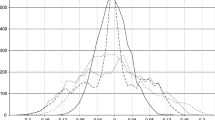

One of the single most cited studies within the field of nonstationary panel data analysis is that of LLC (Levin et al. in J Econom 98:1–24, 2002), in which the authors propose a test for a common unit root in the panel. Using both theoretical arguments and simulation evidence, we show that this test can be misleading unless it is based on the same bandwidth selection rule used by LLC.

Similar content being viewed by others

References

Andrews DWK (1991) Heteroskedasticity and autocorrelation consistent covariance matrix estimation. Econometrica 59: 817–858

Basher SA, Mohsin M (2004) PPP tests in cointegrated panels: evidence from Asian developing countries. Appl Econ Lett 11: 163–166

Breitung J (2000) The local power of some unit root tests for panel data. In: Baltagi B (eds) Advances in econometrics: nonstationary panels, panel cointegration, and dynamic panels. JAI, Amsterdam, pp 161–178

Breitung J, Das S (2005) Panel unit root test under cross sectional dependence. Stat Neerl 59: 414–433

Campbell J, Perron P (1991) Pitfalls and opportunities: what macroeconomists should know about unit roots. In: Blanchard O, Fishers S (eds) NBER macroeconomics annual. MIT Press, Cambridge

Culver SE, Papell DH (1997) Is there a unit root in the inflation rate? Evidence from sequential break and panel data models. J Appl Econom 12: 436–444

Crespo-Cuaresma J, Fidrmuc J, MacDonald R (2005) The monetary approach to exchange rates in the CEECs. Econ Transit 13: 395–416

Gutierrez L, Gutierrez MM (2003) International R&D spillovers and productivity growth in the agricultural sector a panel cointegration approach. Eur Rev Agric Econ 30: 281–303

Hlouskova J, Wagner M (2006) The performance of panel unit root and stationarity tests: results from a large scale simulation study. Econom Rev 25: 85–116

Jenkins MA, Snaith SM (2005) Tests of purchasing power parity via cointegration analysis of heterogeneous panels with consumer price indices. J Macroecon 27: 345–362

Jönsson K (2005) Cross-sectional dependency and size distortion in a small-sample homogenous panel data unit root test. Oxford Bull Econ Stat 67: 369–392

Kao C (1999) Spurious regression and residual-based tests for cointegration in panel data. J Econom 90: 1–44

Karlsson S, Löthgren M (2000) On the power and interpretation of panel unit root tests. Econ Lett 66: 249–255

Kim H, Oh K-Y, Jeong C-W (2005) Panel cointegration results on international capital mobility in asian economies. J Int Money Finance 24: 71–82

Levin A, Lin CF, Chu J (2002) Unit root tests in panel data: asymptotic and finite sample properties. J Econom 98: 1–24

Maddala GS, Wu S (1999) A comparative study of unit root tests with panel data and a new simple test. Oxford Bull Econ Stat 61: 631–652

Moon HR, Perron B (2004) Testing for a unit root in panels with dynamic factors. J Econom 122: 81–126

Newey W, West K (1994) Autocovariance lag selection in covariance matrix estimation. Rev Econ Stud 61: 613–653

Ng S, Perron P (1995) Unit root test in ARMA models with data-dependent methods for the selection of the truncation lag. J Am Stat Assoc 90: 268–281

O’Connell P (1998) The overvaluation of purchasing power parity. J Int Econ 44: 1–19

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Westerlund, J. A note on the use of the LLC panel unit root test. Empir Econ 37, 517–531 (2009). https://doi.org/10.1007/s00181-008-0244-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-008-0244-8